What is Mutual Fund ?

In order to understand mutual funds let’s make sure you understand stocks/share of a company:

Assume you have a box of candy(identical flavour). You decide to share the candy with your friends instead of eating it all by yourself. Each friend receives a piece of candy.

Similarly, When a company(box of candy) wants to expand, it divides itself into smaller pieces(a candy) known as shares. People can purchase these shares(a candy) to become shareholders in the company. Stocks are now similar to these company shares.

When you buy a stock, you are purchasing a small portion of the company. The value of these stocks can fluctuate depending on how well the company performs.

Now assume candies can be of different type:

Sweet candy, sour candy, chewy candy, crunchy candy.

Each type of candy represent different company.

So if you want to buy a sweet candy(share) you have to own that from sweet candy factory(company)

Similarly it goes for sour candy, chewy candy and crunchy candy.

Now we set the context, it will be easier to understand Mutual Fund Now:

Let’s discuss Mutual Funds.

Say Ashray, Prateek and Moin went market to buy candies:

They played smart here, they are not sure if they would like the taste of some candies so instead of buying separately they reached out a good candy shop and put their money together in a basket of the shopkeeper.

Shopkeeper took the money and gave them bunch of different types of candies.

A mutual fund is similar to a large basket in which many people pool their money to buy various stocks rather than just one stock.

It’s like a group of friends pooling their money to buy a variety of candies rather than just one.

Consider a mutual fund to be a large collection of various candies. Instead of buying just one type of candy, you invest in a collection that includes a variety of candies—some sweet, some sour, some chewy, and some crunchy.

This way, even if one candy does not taste good or performs poorly, you still have other candies that may taste better or perform better.

Point to note:

You are NOT buying shares/stocks when investing in Mutual funds. You are participating in that basket of money where you will get the percentage return how the MF will perform.

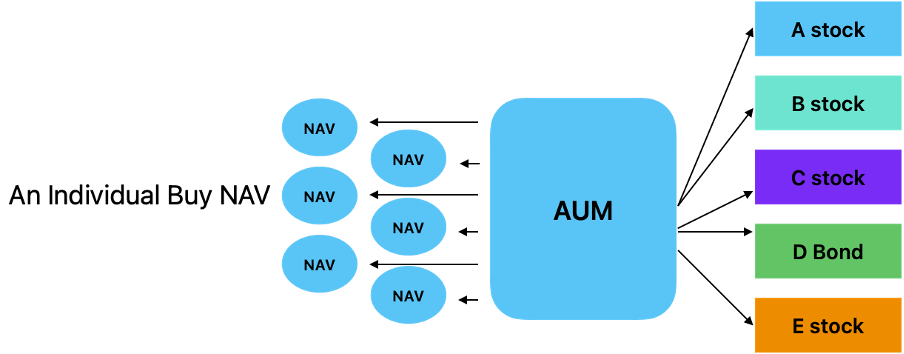

Total basket of money is known as AUM ( Asset under Management)

Let’s understand with example below:

AUM is equivalent to the total number of candies in the jar multiplied by the price of each candy. If each candy costs $1 and there are 100 in the jar, the AUM is $100 (100 candies x $1 each). Similarly, the AUM of a mutual fund represents the total value of all investments in that fund. If a mutual fund has 1,000 outstanding units and each unit is priced at $10 (NAV), the AUM is $10,000 (1,000 units x $10).

The portion of basket which you buy as a unit of MF is known as NAV(Net Asset Value):

Let’s understand with example below:

A mutual fund’s Net Asset Value (NAV) is analogous to the price of each candy in the jar. Assume the jar contains 100 candies in total, with a total value of $100 for all of these candies. In this case, the NAV is $1 per candy ($100 total value divided by 100 candies). Similarly, the NAV of a mutual fund represents the price of each fund unit. If the NAV of a mutual fund is $10, it means that one unit of the fund is worth $10. The NAV changes as the value of the fund’s underlying assets changes.

Mutual Fund Types:

Stock funds: invest in stocks of various companies. They can concentrate on large corporations, small businesses, or specific industries such as technology or healthcare.

Bond funds: invest in bonds rather than stocks, which are similar to loans to companies or governments. Bonds are typically less risky than stocks, but they also provide lower returns.

Balanced funds: invest in both stocks and bonds in order to balance risk and potential returns.

Index funds: track a specific stock market index (such as the S&P 500) and attempt to match its performance. They are less actively managed and attempt to replicate the index.

Money Market Funds: These are extremely safe funds that invest in government securities and short-term debt.

Point to note:

Remember that when you buy a mutual fund, you are purchasing a portfolio of stocks or bonds. This helps to reduce risk because if one company’s stock falls, it may not have as much of an impact on the entire mutual fund.

So, mutual funds are a way for a group of people to invest together and spread their money across various types of investments, reducing risk and potentially growing their money over time.

Now how to buy Mutual Fund,

First you need to keep few things in mind before buying a mutual fund:

Direct Growth and Regular Mutual Funds are two types of mutual fund investment options that differ in terms of how you invest and the expenses associated with them.

We will talk about the expenses associated with Mutual Fund later after discussing what are Direct Growth and Regular Mutual Funds

Direct Growth Mutual Funds:

These funds can be purchased directly from the mutual fund company or through their website, eliminating the need for a distributor or intermediary such as a broker or advisor.

They have lower expense ratios because there are no commissions or fees paid to intermediaries.

Direct growth fund investors typically conduct their own research, select funds, and manage their investments without the assistance of a financial advisor.

It is just like you researched and found which candy shop will fulfil your requirement. Then going to the candy shop and buying it from there.

PS: I personally prefer this MF as it does not include unnecessary charges

Regular Mutual Funds:

These funds are acquired through the services of intermediaries such as financial advisors, brokers, or agents.

They may have higher expense ratios due to commissions or fees paid to the intermediary who assists in the purchase and management of the funds.

Investors who choose regular mutual funds frequently receive investment advice and guidance from financial professionals. It is like, you are unaware which candy shop to go and you asked one of your friends to help and in return he asked you to give 1 or 2 % of the candies you buy.

PS: 1 or 2% looks smaller in number but in a long run and compounding they take good amount of your profit.

Now let’s talk of Expenses associated with Mutual Funds which we talked about earlier:

Exit Load and Expense Ratio are important terms related to mutual funds that investors should understand:

Exit Load:

The term “exit load” refers to a fee charged by mutual funds when an investor sells or redeems their investment before a certain period, known as the exit load period.

It is essentially a penalty imposed on investors for early withdrawal.

The exit load’s purpose is to discourage investors from withdrawing their money too soon, which can disrupt fund management and negatively impact other investors.

Mutual funds are transferred from one to another.

Some funds may not have any kind of exit load. For example, if an investor withdraws their investment within one year of investing, a mutual fund may impose an exit load of 1%.

If someone invested $1,000 and withdrew it within the exit load period, they would be charged a $10 (1% of $1,000) exit load fee.

PS: Make sure the Exit Load as low as possible(near to 0) for MF you are buying

Expense Ratio:

The expense ratio is the annual fee that mutual funds charge to cover operating expenses.

Management fees, administrative expenses, marketing expenses, and other operational costs incurred in managing the fund are all included.

It is expressed as a percentage of the average net assets of the fund and is deducted from the fund’s returns.

A lower expense ratio is generally better for investors because it means that less of the fund’s return is used to cover expenses.

For example, if a mutual fund has an expense ratio of 1.5%, it means that $15 is deducted annually from each $1,000 invested in the fund to cover expenses.

PS: 0.5 to 0.75% is considered reasonable expense ratio. However, it can be lower for index fund MF, up to 0% and higher also for some MFs.

Below are some snaps to understand where and how to see Expense Ratio, Exit load and current NAV(NOT a BUYING RECOMENDATION)

I personally use Coin by Zerodha to buy MF.

Thank you for such a detailed explanation.