Yes, you can make you money double in ~7 years. 72 is the Magic number you are going to learn today. Below article will give you good explanation on this rule , Bonus tip also included on How to save money and start your investment. Read it fully

I personally apply below two RULEs in my earning and I have seen great results. I believe in “sharing is caring”. If I can take advantage of all these rules and become financially stable why can’t you ?

You need to know this basic rule which is RULE of 72

What is RULE of 72?

– You can quickly calculate how long it will `take to double your investment by using the Rule of 72.

– To find the approximate number of years it will take for your investment to double, divide 72 by the annual interest rate.

– For instance, it would take about 9 years for your investment to double if it earned an 8% annual interest rate (72 divided by 8 equals 9).

– It’s a straightforward but helpful tool for figuring out the compound interest effect and estimating how much an investment will grow over time.

- Normal index FUND gives you 12 to 12.5 % of return.

- Lets take this in a very safer return, say 10% (You can choose any investment plan(like Mutual Fund) per your wish, I am hypothetically taking index fund)

read about mutual fund here : https://mangoleon.com/what-is-mutual-fund-and-how-to-buy/

You can also check what is T-Bill: https://mangoleon.com/know-about-t-bills/

- Now divide 72 by 10 you will get 7.2 , basically which means you will have your money doubled in 7.2 years.

Is not this RULE of 72 is fascinating ? Calculate you investment plan and see in how many years it is going to go DOUBLE.

Bonus TIP for you :

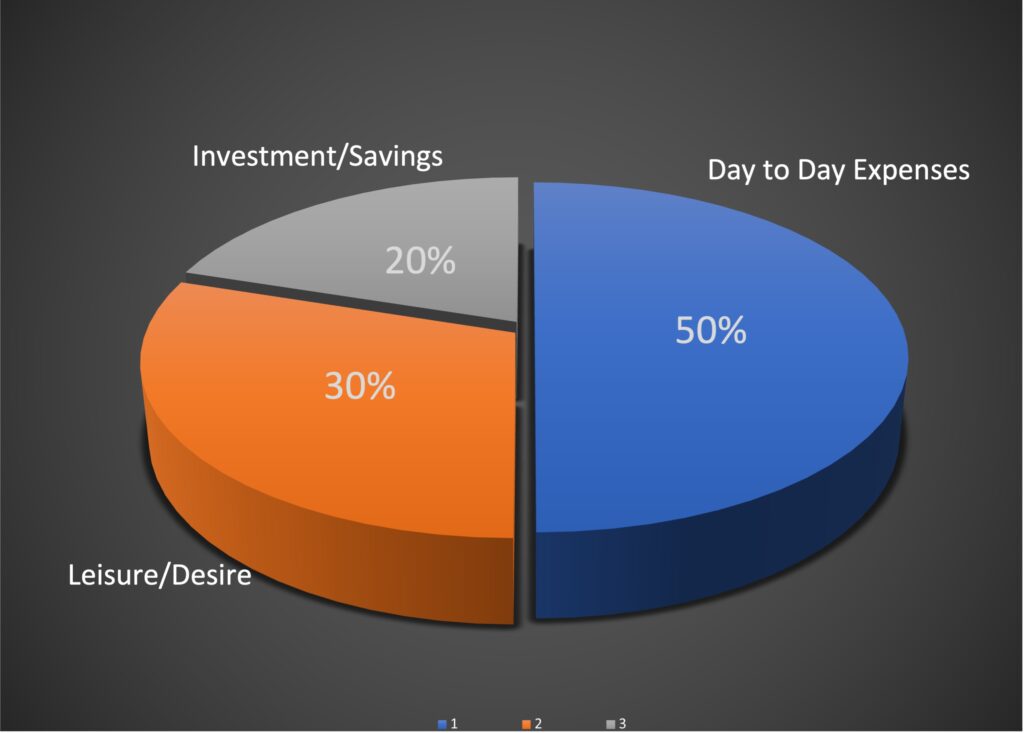

50-30-20 Rule:

If you unable to start any investment or struggling with budgeting you money for normal expenses you should consider 50-30-20 Rule

What is this 50-30-20 Rule?

Divide your income in below percentages :

50%, 30%, 20% : Say you have monthly earning of Rs 50000

Then 50%= 25000, 30%=15000, 20%=10000

Rule of 50: Keep your 50 % of salary for your day to day expenses like, rent, food, transport, grocery, education and others bill.

Rule of 30: 30% of your salary can pe spent on your leisure and desires like, holidays, movies, restaurants.

Rule of 20: At least 20 % of your Salary must be kept aside for your investment/Savings.