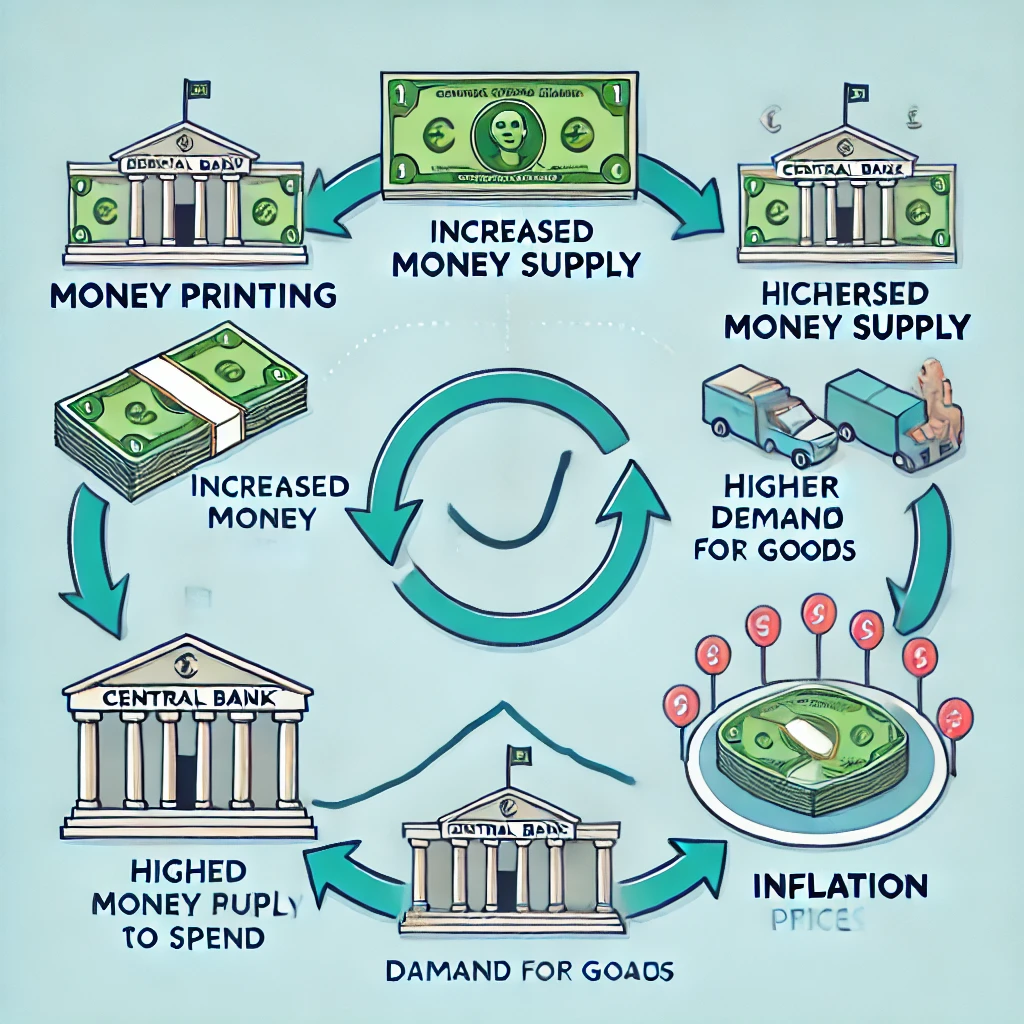

During economic downturns, governments and central banks resort to printing money as a means to boost the economy. However, this approach typically leads to inflation and comes with its own set of consequences. How exactly does the increased printing of money contribute to the increase in prices? Let’s delve into the details.

1. An Overview of Money Supply:

Essentially, money symbolizes the worth of goods and services within an economy. Stability in prices is maintained when there is equilibrium between the existing amount of money and the level of production. Nevertheless, introducing new money without a proportional rise in production can give rise to issues.

2. Too Much Money, Same Amount of Goods

Envision the economy as a market brimming with merchandise such as groceries, electronics, and houses. Then, picture a sudden surge of cash entering the market. A greater number of individuals now have more money at their disposal. As a result, there is a natural rise in the demand for the merchandise in the market. Nevertheless, if the supply of these goods does not increase, businesses will be unable to fulfill this heightened demand.

3. Increasing Prices (Inflation)

Whenever demand exceeds supply, companies increase their prices. This is when inflation occurs. When there is more money in circulation for the same amount of goods and services, prices go up. Although a certain level of inflation is typical in a growing economy, excessive printing of money can result in price increases that surpass wage growth, leading to higher costs for everyday goods.

4. The Erosion of Purchasing Power

As prices go up, the value of money decreases. If your money doesn’t go as far as it used to, you are experiencing a reduction in purchasing power. This means that $100 today may not purchase the same quantity of goods it could have a year ago. This situation can be particularly difficult for those with fixed incomes or savings, as their money’s worth is reduced.

5. The Danger of Hyperinflation

If the printing of money becomes unmanageable, it can result in hyperinflation—a severe and swift escalation in prices that can devalue a country’s currency. Notable instances of this include Zimbabwe in the late 2000s and Germany’s Weimar Republic in the 1920s. In such scenarios, money is printed so rapidly that prices escalate daily, causing the economy to descend into disarray.

Although printing money may appear to be a simple remedy for economic troubles, it is a tool that must be wielded cautiously. When the money supply expands more rapidly than the production of goods and services, inflation becomes unavoidable. To sustain a robust economy, there must be a harmony between the money supply and productivity.