Macroeconomics-Interest Rates and the Stock Market Interaction:

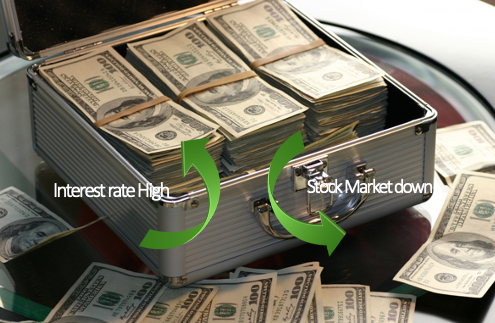

There is a relationship between interest rates and the stock market. When the central bank lowers interest rates, easier access to credit encourages stock investment, which boosts the market. On the other hand, if rates increase, stock market growth may slow.

It’s important to note how the stock market and GDP are related. A positive GDP forecast suggests potential growth in business output, which frequently triggers a rise in the stock market.

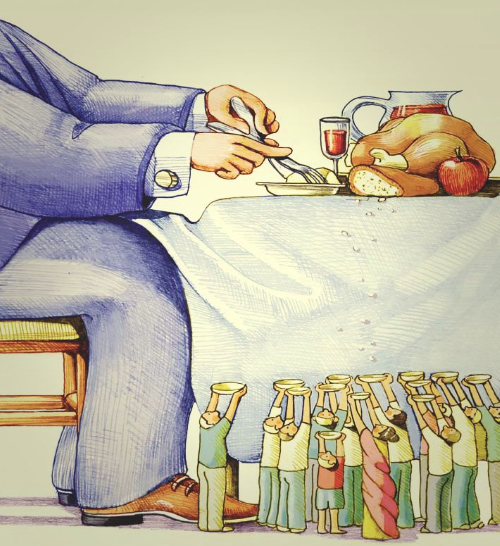

Government money printing known as quantitative easing can reduce a currency’s purchasing power and even lead to inflation. This policy may make it easier for the wealthy to obtain low-interest loans, which may increase wealth inequality.

The stock market offers a variety of asset classes:

Given that actual inflation may be significantly higher than reported figures, aiming for a 14–20% Compound Annual Growth Rate (CAGR) return becomes crucial in order to potentially outpace inflation.

The adage “Investing is risky, but not investing is riskier” emphasizes the danger of missing out on investment opportunities because of risk aversion.

Governments frequently promote stock investments because they have fewer restrictions, are simpler to trade, and have lower transaction costs than other assets like real estate, which have high stamp duties.

Asset classes include:

Liquid assets, such as commercial properties, that produce positive cash flow.

Hard assets, such as gold, for risk diversification.

Soft assets, such as stocks, bonds, and cryptocurrencies.

Low-Risk Investment Strategy to Outperform Index Returns:

The Indian market has experienced a significant period of correction, which could pave the way for favorable average returns in the ensuing years.

Investors can enter the market strategically by locating areas where they can buy large quantities of fundamentally sound stocks.

Opportunities to profit from market shifts can be found by keeping an eye on sector rotations and making investments in undervalued sectors, such as the current NIFTY IT index.